One of the most overlooked elements of a car insurance policy is the Insured Declared Value or IDV. This is a crucial factor that represents your car’s current market worth and serves as the maximum amount your insurer will pay if the vehicle is stolen or suffers total damage.

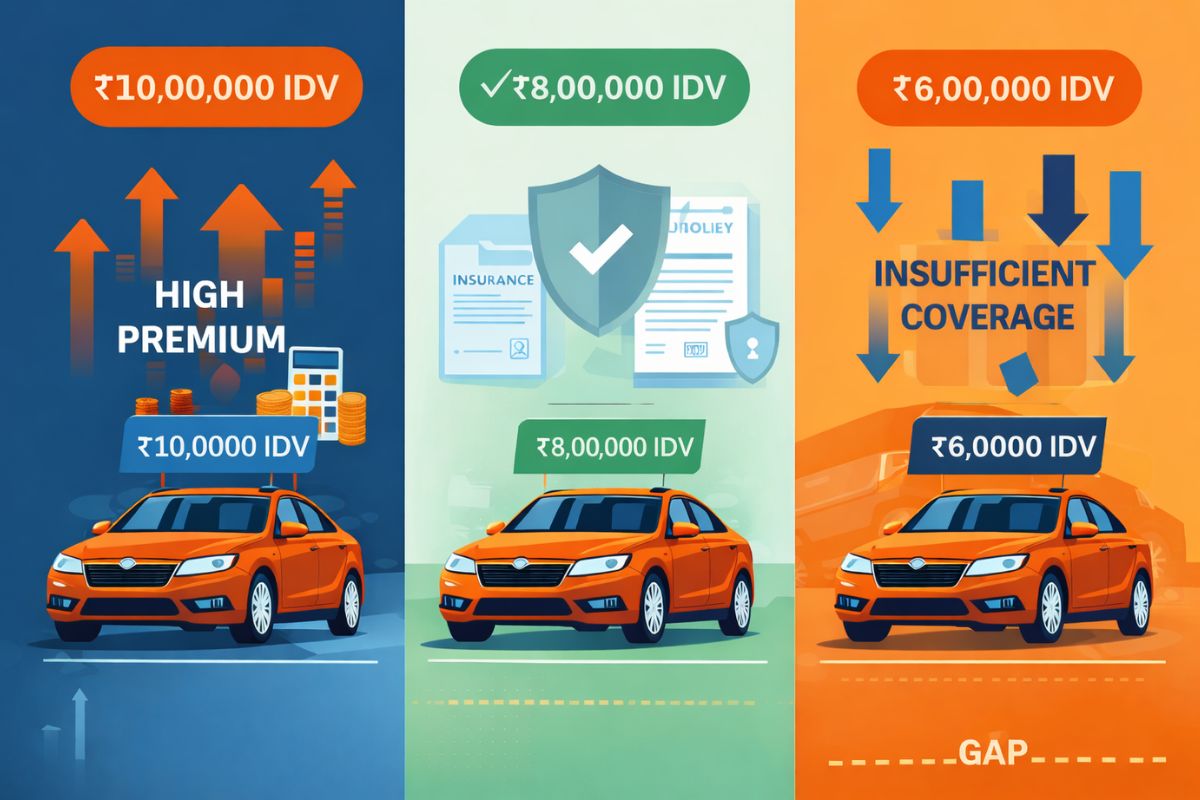

Choosing the right IDV in car insurance is not just about numbers. It is about balance. A value that is too high means unnecessary premiums, while one that is too low can leave you under-protected when you need coverage the most. Getting it right ensures your policy works for you, not against you.

What is IDV in Car Insurance and Why Does it Matter?

At the time of car insurance renewal or purchase, many car owners don’t pay attention to the IDV of their vehicle. That is a mistake. Your car’s value changes every year due to depreciation, and your IDV should reflect that change accurately.

A properly updated IDV ensures you pay a fair premium and receive the correct payout if you face a total loss or theft. If your insurer lowers the IDV more than necessary, your claim amount might fall short of what your car is truly worth. Similarly, setting it unrealistically high can increase your renewal cost with no real benefit.

Before you renew, always review the suggested IDV and compare it with your car’s market price. Taking this small step can prevent major disappointments later.

Common Problems from Incorrect IDV

Many car owners face trouble during car insurance renewal because their IDV is not set correctly. Two common mistakes stand out: under-insurance and overpayment.

If you choose a low IDV to reduce your premium, you could end up with a payout that does not cover your actual loss. For instance, if your car is worth ₹7 lakh but your policy lists an IDV of ₹5 lakh, you will only receive ₹5 lakh in the event of total damage, leaving you to bear the remaining ₹2 lakh.

On the other hand, setting a high IDV might make your policy look better on paper, but it unnecessarily raises your premium. You will pay more without getting additional coverage.

The key is to understand that IDV is not a guess. It is a calculated figure that should match your car’s true depreciated value. Ignoring this during renewal can lead to disputes, inadequate claims, or avoidable costs later on.

What Should the IDV Be While Renewing Your Car Insurance?

Before your next renewal, take a moment to verify your car’s current market price. The right IDV depends on the model, age and condition of your car. Newer cars usually retain higher IDV values, while older ones depreciate faster.

You can use your insurer’s online calculator or check standard depreciation tables to get an estimate. Many insurers allow policyholders to adjust their IDV within a certain range. If you have maintained your vehicle well or added safety features like anti-theft devices, you may be able to choose a slightly higher value within that limit.

Reviewing this number annually before your car insurance renewal ensures that your coverage remains accurate and your premium fair.

Conclusion

Your IDV in car insurance may seem like a minor detail, but it defines the strength of your coverage. Setting it thoughtfully helps you avoid claim disputes and unnecessary costs later.

When you renew with reliable insurers like TATA AIG, you can easily check, compare and set the right IDV online. It’s a simple way to make sure your car is valued correctly, so you pay a fair premium, receive the right payouts and stay protected year after year.

Disclaimer: This content is sponsored and does not reflect the views or opinions of Ground Report. No journalist is involved in creating sponsored material and it does not imply any endorsement by the editorial team. Ground Report Digital LLP. takes no responsibility for the content that appears in sponsored articles and the consequences thereof, directly, indirectly or in any manner. Viewer discretion is advised.

Support us to keep independent environmental journalism alive in India.

Stay connected with Ground Report for underreported environmental stories.