India’s battery storage market changed in 2024. For the first time, battery operators made more money than they spent. They did this by trading power on the open market without fixed contracts. They charged their batteries when prices were low. They sold power back when prices jumped. That simple strategy made profits.

Merchant BESS Profitable Amid Price Swings

A new report by Ember shows that merchant battery energy storage systems (BESS), which operate without fixed contracts, became commercially viable in 2024. Battery costs dropped sharply. Power prices grew more volatile. These changes allowed BESS developers to earn enough from trading and grid services to recover costs and deliver strong returns.

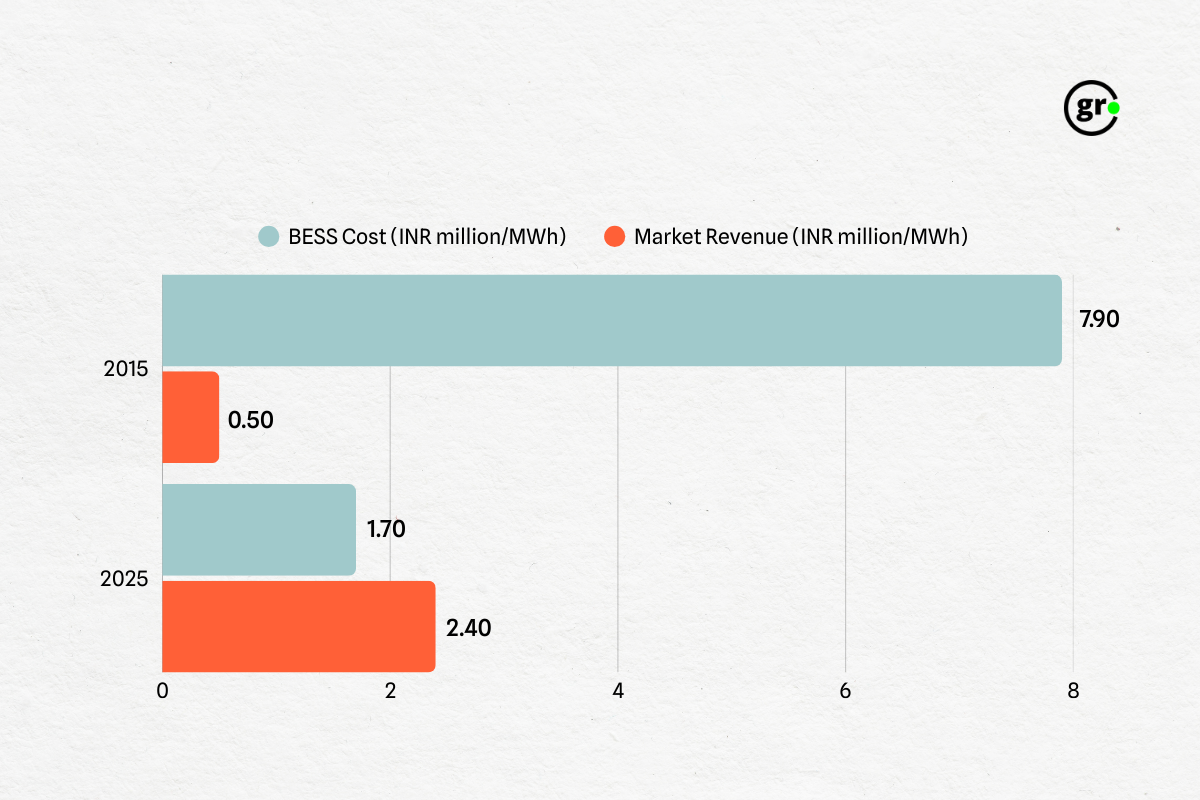

The lead authors Duttatreya Das and Neshwin Rodrigues of the report explain, that battery prices fell 80 percent over the past decade. By 2025, the cost of installing a BESS stood at INR 1.7 million per megawatt-hour. A decade earlier it stood at INR 7.9 million per megawatt-hour. At the same time, revenue opportunities from participating in India’s power exchanges rose fivefold, from INR 0.5 million to INR 2.4 million per megawatt-hour.

“Merchant BESS has often been viewed as a low-return investment,” said Das, Energy Analyst at Ember and co-author of the report. “But the changing dynamics of the wholesale power market, with rising price volatility and falling battery costs, have made it commercially viable today.”

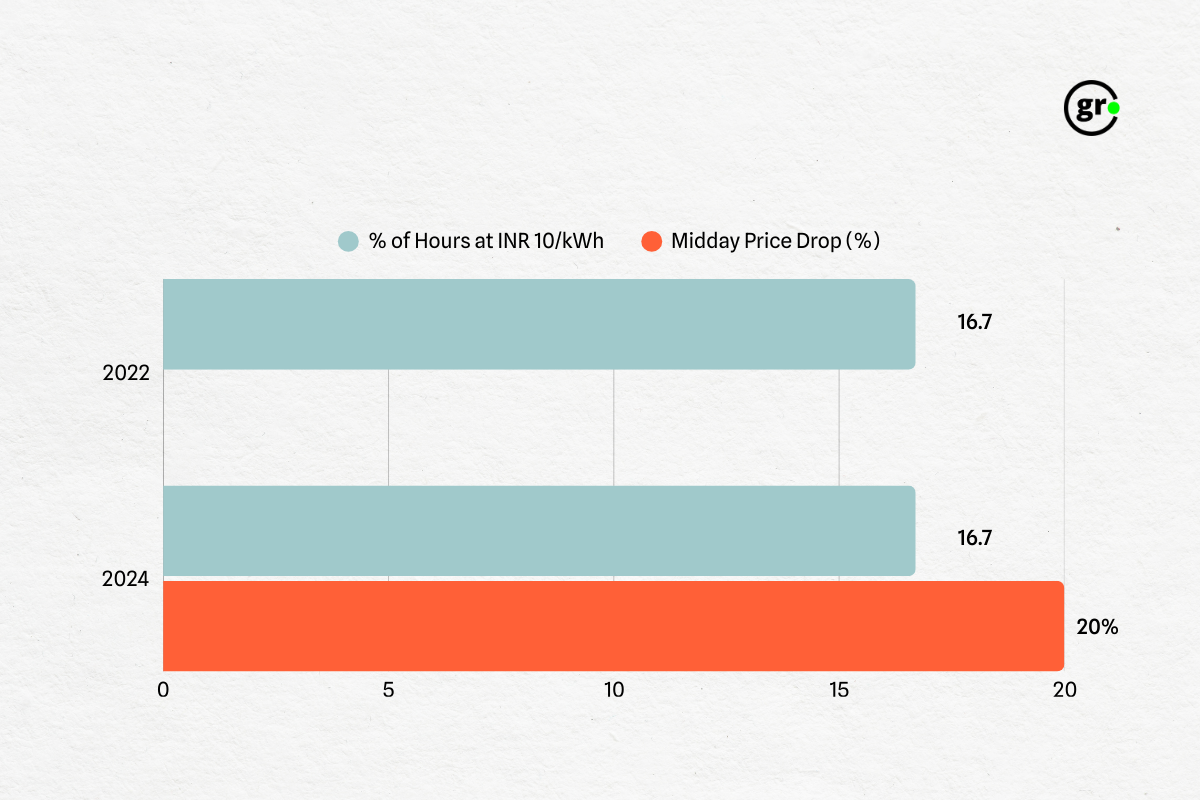

The new price volatility in India’s Day Ahead Market created large discrepancies between peak and trough electricity prices. The study data shows that wholesale prices hit the market cap of INR 10/kWh in one out of every six hours between 2022 and 2024. At the same time, midday prices dropped sharply, falling nearly 20 percent during summer by 2024. These swings made price arbitrage, charging during cheap hours and selling during expensive hours, a viable business strategy.

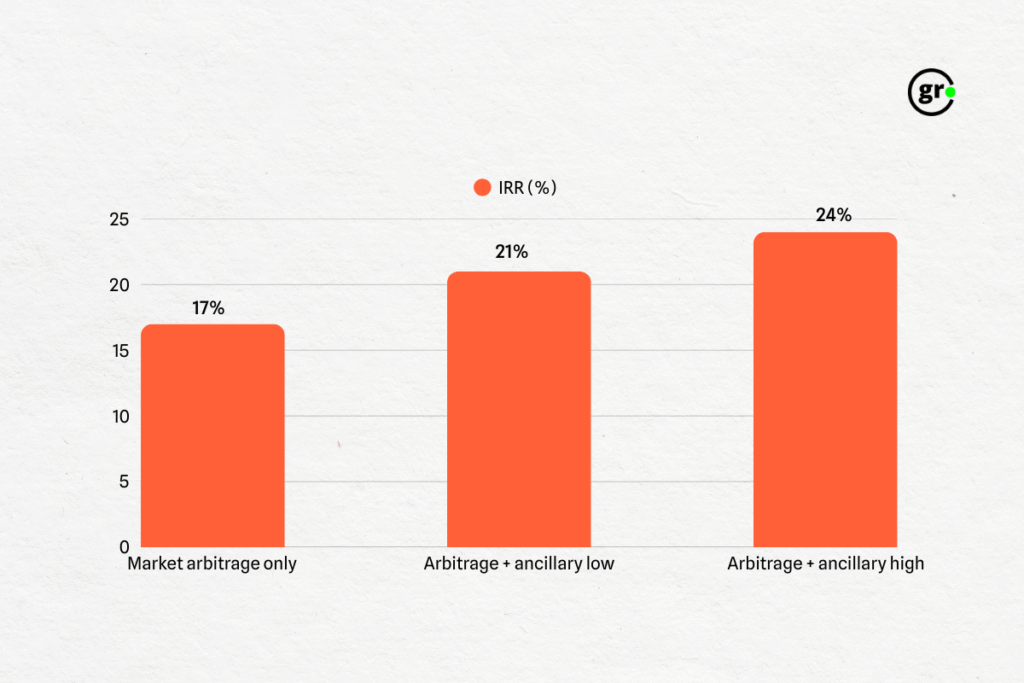

Rodrigues, Senior Energy Analyst at Ember, said that trading in the day-ahead market alone can generate internal rates of return (IRRs) of up to 17 percent, for battery projects commissioned in 2025. He added that participation in ancillary services like grid balancing can add another 15 to 20 percent in revenue.

Batteries Fill Grid Reserve Gaps

Figures show total earnings per megawatt-hour can reach INR 3.3 million when combining market arbitrage and ancillary services. That pushes IRRs up to 24 percent under optimistic scenarios. Even under conservative price forecasts, IRRs remain near 21 percent, with a larger share of revenue coming from grid services.

Satyadeep Jain, Director of Equity Research at Ambit Private Limited, said that market participation by batteries has been under-appreciated until now. “There are multiple use cases for batteries,” he said, “and participation in the merchant market is one that’s been somewhat under-appreciated.”

The report adds new insight on gaps in India’s ancillary services mechanism. Thermal power plants dominate the existing framework. They respond slowly. This limits grid balancing during midday and night. On 26 May 2025, India’s grid lacked adequate reserves: downward spinning reserves were nearly zero for five daytime hours, while upward reserves were zero for three nighttime hours. These episodes highlight systemic grid risk.

Das said that these reserve shortfalls underscore the growing role for fast-acting storage. Coal and hydro generators, the main providers of ancillary services, are often too slow to respond to sudden imbalances. India’s Ancillary Services framework introduced in 2023 includes SRAS and TRAS. SRAS prioritises resources based on ramp speed and cost, allowing batteries, pumped hydro and demand response to compete. TRAS focuses on day-ahead procurement of reserves.

“Fast-acting resources like batteries now play a critical role in grid balancing,” said Das. “The gaps we saw in reserves during May show that conventional generators no longer suffice.”

Batteries can now earn money by charging when the grid needs downward power (SRAS-Down). They might even earn a bonus for precise dispatch. In emergency downward situations (TRAS-Down), batteries could absorb surplus power at lower cost than curtailing renewable generators and paying compensation.

Ember modelling shows that even a two-hour battery charging during surplus midday can make revenue when selling at INR 10/kWh. After accounting for round‑trip efficiency and levelised cost of storage (LCOS), the net earnings can exceed INR 2.5 per kWh.

India’s Battery Push

By June 2025, India installed 168 gigawatts of solar and wind power, with another 145 GW in development. The government aims for 500 GW of non-fossil fuel capacity by 2030. As renewable energy use grows, it causes price fluctuations and strains the grid. Batteries help balance supply by storing extra solar energy for evening use and reduce grid stress by limiting the need for coal power.

As of June 2024, operational battery storage stood at only 500 megawatt‑hours. A development pipeline of 121 gigawatt‑hours exists, with 62 GWh under construction and 59 GWh in tendering.

The report shows that shorter-duration systems offer better returns in today’s volatile market. A one- or two-hour battery captures sharp price spreads more effectively than longer-duration models. Though the IRR difference is modest, it matters for investors sizing projects.

Das said that rising solar penetration will further intensify midday price collapses. Thermal plants cannot ramp down quickly. They continue operating at minimum technical load or shut down entirely. That behavior exaggerates price troughs by day and price peaks by night.

Jain added that returns depend on how price volatility evolves. “Returns depend on future price spreads,” he said. “But current trends support the case for merchant BESS investments.”

Merchant battery storage now ranks as a credible infrastructure option in India. It offers a reliable path to recover costs and earn double-digit returns by serving market needs.

For individual communities, batteries could translate into more reliable power. They could reduce the risk of grid outages by supplying energy when demand spikes or generation falls short. That steady supply matters in regions where grid reliability still lags.

As India’s grid shifts toward more variable renewable sources, and price swings remain, merchant battery storage offers both system relief and financial return. It delivers tangible benefits for developers, investors and end users.

Keep Reading

Indore Startup Swaaha takes the lead in making Amarnath Yatra eco-friendly

Amarnath Yatra: Tackling rising death toll from extreme weather events

Amarnath yatra pilgrims urinating in Sindh river: A threat to environment

Stay connected with Ground Report for underreported environmental stories.

Follow us on X, Instagram, and Facebook; share your thoughts at greport2018@gmail.com; subscribe to our weekly newsletter for deep dives from the margins; join our WhatsApp community for real-time updates; and catch our video reports on YouTube.

Your support amplifies voices too often overlooked, thank you for being part of the movement.