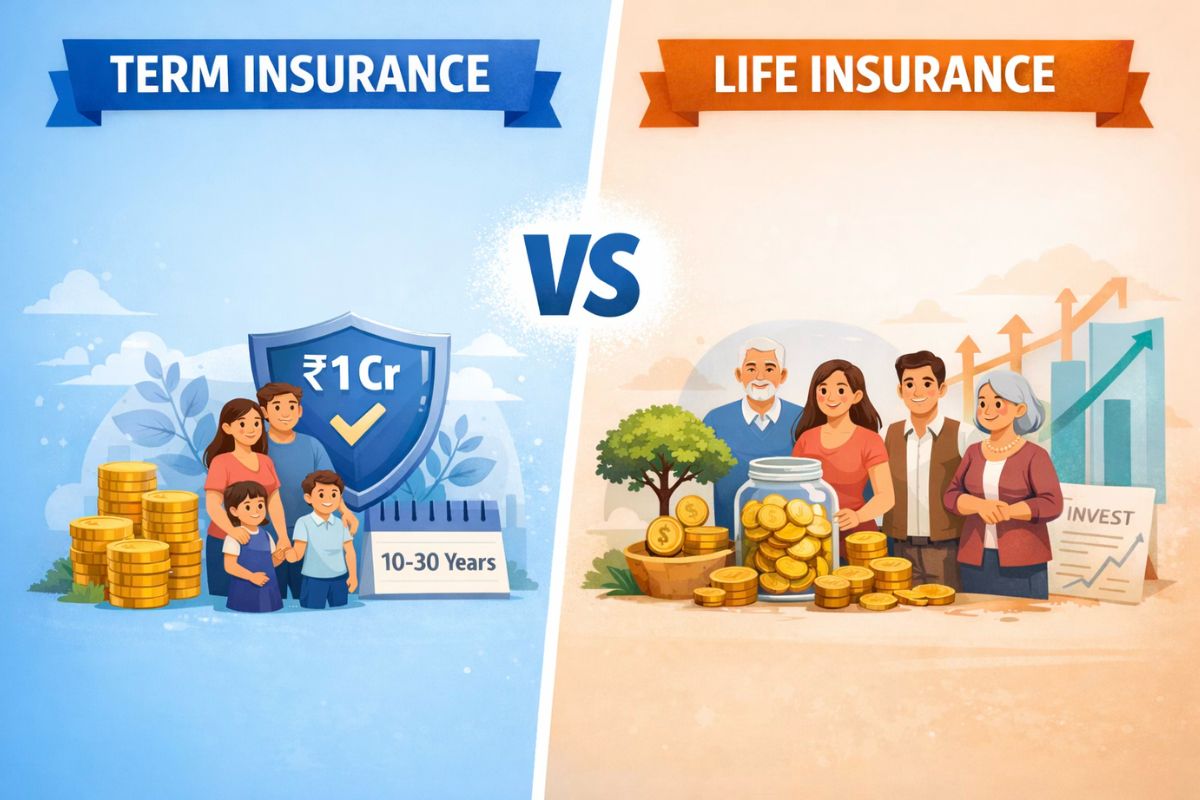

Selecting an insurance policy requires clarity on the type of protection needed. A comparison between Term Insurance and Life Insurance is less about deciding which option is better and more about identifying which option fits their financial situation. Looking closely at the differences helps explain how coverage, premium levels, and policy outcomes vary over time. This clarity is important when planning for income replacement, ongoing responsibilities, or long-term asset creation.

When chosen with a clear purpose, an insurance policy can also help in tax planning. Premiums paid on certain eligible policies may qualify for deductions under applicable income tax provisions, allowing protection and financial discipline to work together to give the maximum benefit.

Understanding Term Insurance

In a Term Insurance policy, you choose a fixed term, such as 10, 20, or 30 years, and a sum assured. If the life insured passes away during the period, the nominee receives the sum assured. If the policy term ends and the life insured is still alive, the policy ends without any maturity benefit.

Affordability is one reason this form of protection is preferred by many people. It offers good coverage at a relatively low premium, making it suitable for young professionals at the start of their careers, parents planning for their children’s education, newly married couples securing their spouses’ financial futures, and self-employed individuals managing loan obligations. The purpose of this policy is to secure coverage without straining household budgets.

Benefits of Choosing Term Insurance

Term insurance provides financial protection with clarity and cost control, especially during the high-responsibility stage of life. Below are some benefits:

- Affordability: A large sum assured can be secured at a lower premium, keeping regular expenses manageable.

- Clarity of cover: The structure is simple, with no savings or investment component, so the benefit payable is clearly defined.

- Customisable duration: The policy term can be customised to specific obligations, such as repaying the home loan or funding a child’s education.

Understanding Life Insurance

A Life Insurance policy provides protection for a longer duration, often for the entire life or until a specified age, at which point the policy matures. In addition to the death benefit, many Life Insurance plans available in the market, including those offered by trusted insurers like Aviva India, provide a maturity benefit. In such cases, the life insured receives a payout upon surviving the policy term, along with a savings or investment component that grows in value over time.

Because of this structure, Life Insurance is commonly used for long-term needs such as retirement planning, wealth accumulation, or passing on assets to the next generation. While the premiums are higher, the added value comes from combining long-term protection with structured savings and a maturity payout in a single plan, making it easier to plan across different life stages.

Benefits of Choosing Life Insurance

Life Insurance is well-suited to long-term financial planning, combining protection with structured financial outcomes. Below are some key benefits of choosing a Life Insurance policy:

- Long-term cover: Insurance remains in place for life or until a defined maturity age, providing long-term financial assurance.

- Value accumulation: Many policies build savings over time that can be used for retirement needs, education expenses, or unforeseen expenses.

- Estate planning support: Ensures beneficiaries receive financial support without the need to liquidate their existing assets.

Eligibility and Underwriting Requirement

Insurers follow a defined underwriting process to assess risk, determine coverage suitability and ensure compliance before issuing a Life or Term Insurance policy.

- Age eligibility: Policies are issued within specified minimum and maximum entry ages, which differ by product and tenure.

- Income evaluation: The sum assured is assessed against income, existing loans, and overall financial commitments.

- Health assessment: Medical history and current health condition are examined. Medical tests may be required based on age and coverage amount.

- Lifestyle and occupation: Factors such as smoking, alcohol use, and high-risk occupations are considered during assessment.

- Document verification: Identity proof, income documents, and medical reports are checked for accuracy and completeness.

- Disclosure standards: Full and honest disclosure is necessary to determine premium rates and ensure smooth claim processing.

Differences Between Term and Life Insurance

The difference between term and Life Insurance becomes clearer when comparing how each option addresses protection, duration, and long-term financial objectives.

| Aspect | Term Insurance | Life Insurance |

| Primary purpose | Focuses solely on financial protection | Combines protection with savings or investment |

| Coverage duration | Limited to a fixed term | Extends for a lifetime or up to a maturity age |

| Premium levels | Lower and cost-efficient | Higher due to added components |

| Maturity benefit | Not available in standard plans | Available in most plans |

| Death benefit | Payable if death occurs during the term | Payable on death during policy tenure |

| Savings component | Not included | Included in many plans |

| Common use | Income protection and liability coverage | Long-term planning and asset creation |

| Tax Benefit | No benefit under the New Tax Regime | Maturity taxed if premium > ₹5 Lakh |

Example On Tax Benefits of Life and Term Insurance

Let us look at an example to understand how tax treatment influences Life Insurance decisions.

Amit is a 35-year-old salaried professional earning ₹20 lakh annually. He purchases a Life Insurance policy with an annual premium of ₹40,000. Before buying the policy, Amit was already utilising ₹1.1 lakh of his ₹1.5 lakh Section 80C limit through EPF and other investments.

By opting for the Old Tax Regime and applying this policy, Amit uses an additional ₹40,000 of his available 80C limit. This reduces his taxable income by the same amount. At a 30% tax slab (excluding cess), this results in an annual tax saving of around ₹12,000.

If Amit had instead chosen the New Tax Regime, this premium would not have been eligible for any deduction, and his tax liability would have remained unchanged. Understanding this difference helps him align his insurance purchase with the tax regime that suits his situation.

In addition, Amit is aware that if a claim arises, the death benefit paid to his nominee remains fully tax-exempt under Section 10(10D). This clarity allows him to evaluate Life Insurance not just as a protection tool, but as a structured financial decision where protection and tax efficiency work together without complexity.

Conclusion

Choosing between Term Insurance vs Life Insurance in 2026 depends on how protection fits into a broader financial plan. Term Insurance is suitable when the focus is on affordable coverage for specific responsibilities over a defined period. Life Insurance, on the other hand, suits longer-term objectives, combining protection with savings and maturity benefits. Looking at coverage needs, affordability, and the expected duration of responsibilities together helps clarify the decision. With a careful review of personal circumstances and accurate disclosure, the right policy can support financial stability as financial needs evolve over time.

Disclaimer: This content is sponsored and does not reflect the views or opinions of Ground Report. No journalist is involved in creating sponsored material and it does not imply any endorsement by the editorial team. Ground Report Digital LLP. takes no responsibility for the content that appears in sponsored articles and the consequences thereof, directly, indirectly or in any manner. Viewer discretion is advised.

Support us to keep independent environmental journalism alive in India.

Stay connected with Ground Report for underreported environmental stories.